Quelle surprise (or not). Eurozone inflation is on the rise, hitting 2.4% in December while core inflation held steady at 2.7%. As we move into Q1 2025, inflationary pressures show no signs of easing, with energy and food prices driving the trend. Natural gas prices have surged over 50% year-on-year, and oil prices are holding steady, marking a sharp reversal for energy inflation. Meanwhile, food prices are climbing again, fueled by rising agricultural costs. While goods inflation remains relatively low at 0.5%, services inflation has jumped to 4%, driven by strong wage growth and pricing strategies, though a cooling labor market could soften this trend. The ECB is taking a cautious approach to easing, dismissing criticism of being "behind the curve." However, with hawkish policymakers reluctant to overlook supply-side shocks, the ECB’s optimism about inflation cooling to 2.3% in Q1 seems misplaced. Rate cuts will continue, but don’t expect an accelerated pace—2025 is shaping up to be a balancing act for policymakers.

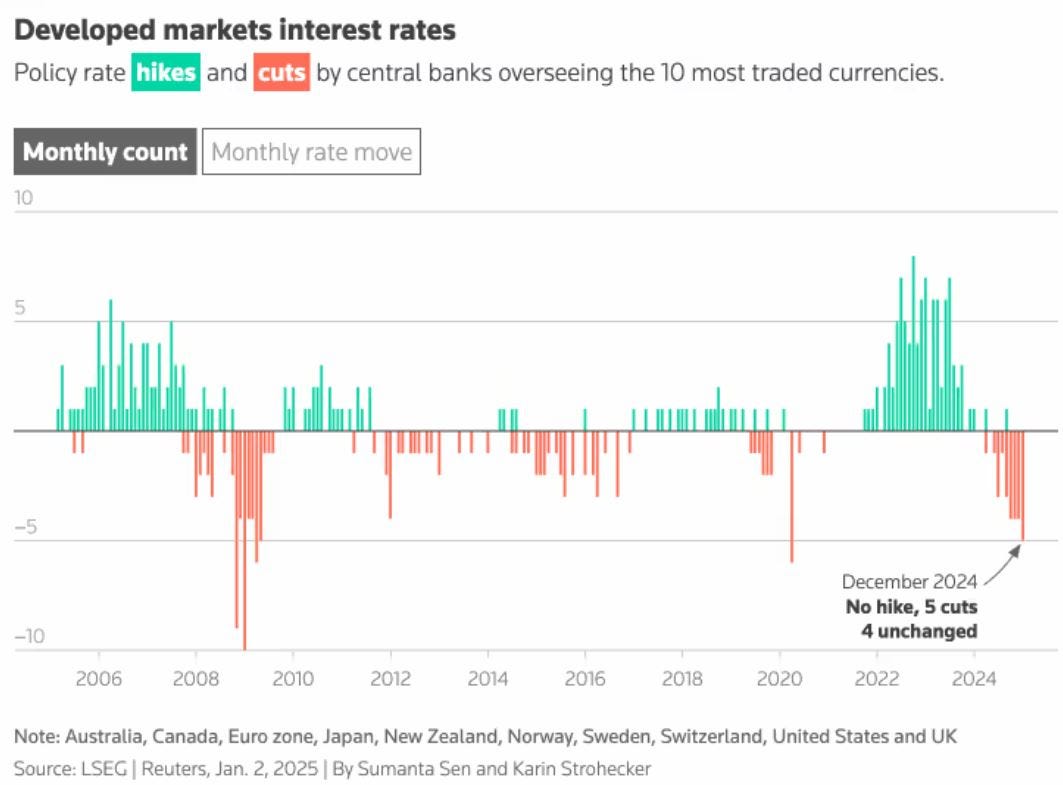

After the release of inflation data for the Eurozone and Switzerland, and with approximately 24 hours remaining until the FOMC Meeting Minutes are published, here’s a quick recap of central bank moves around the world in December.

G10 Central Banks:

Five of nine central banks that met in December cut rates.

Switzerland and Canada reduced rates by 50 basis points (bps), while the Federal Reserve, ECB, and Sweden’s Riksbank cut by 25 bps each.

Policymakers in Australia, Norway, Japan, and Britain held rates steady; New Zealand had no meeting.

Total G10 rate cuts for 2024 reached 825 bps, the largest annual easing since 2009.

Emerging Markets:

14 of 18 central banks in emerging economies meeting in December cut rates.

Turkey made a significant 250 bps cut, while Mexico, Colombia, Chile, and the Philippines cut by 25 bps each.

Brazil stood out by hiking rates by 100 bps.

Total emerging market rate cuts in 2024 amounted to 2,160 bps, more than double 2023’s 945 bps, alongside 1,450 bps in rate hikes.

Overall, central banks implemented their largest policy easing push since the COVID-19 pandemic in March 2020, making 2024 the most significant year for monetary easing in 15 years.

Sources:

reuters.com

PER ASPERA AD ASTRA